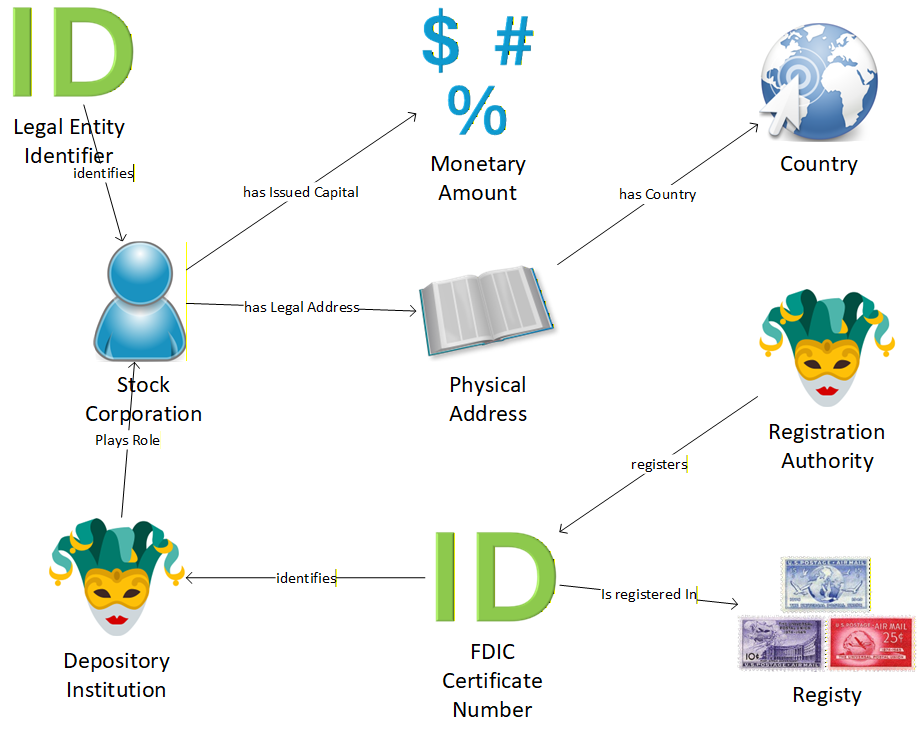

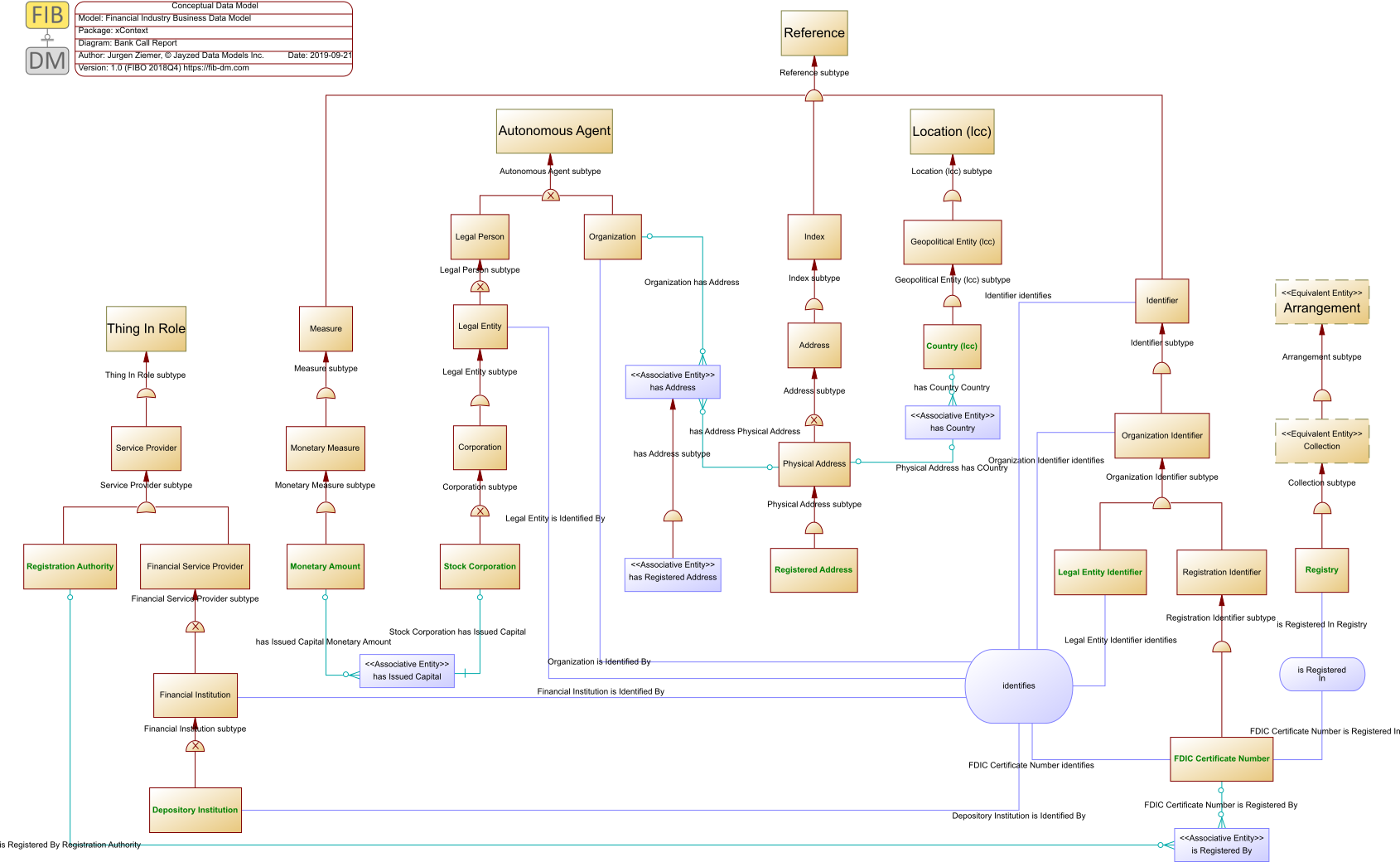

The Banking Data Model is a scope of the Financial Industry Business Data Model (FIB-DM), the largest reference standard for Retail, Commercial, and Investment Banks.

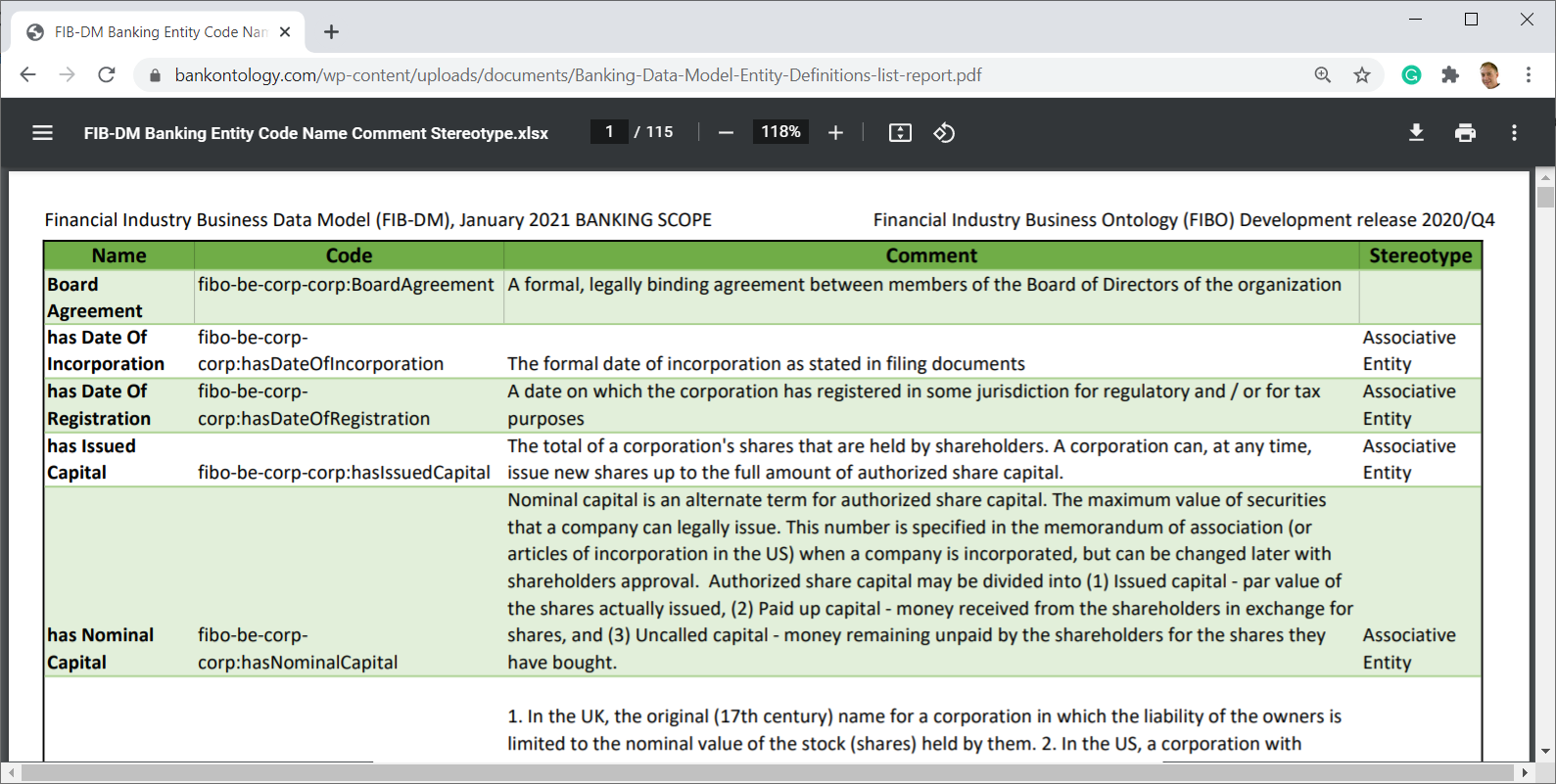

FIB-DM is a complete model transformation of FIBO, the Financial Industry Business Ontology.

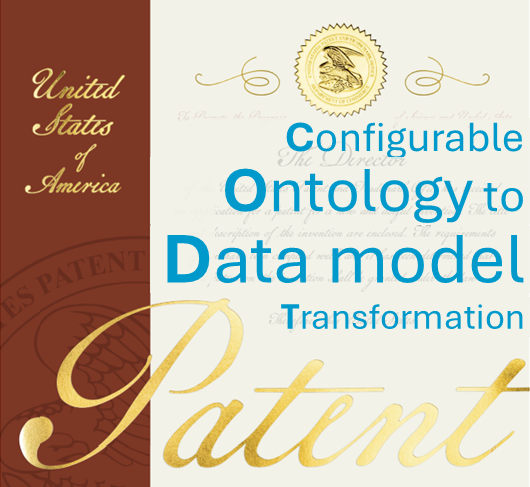

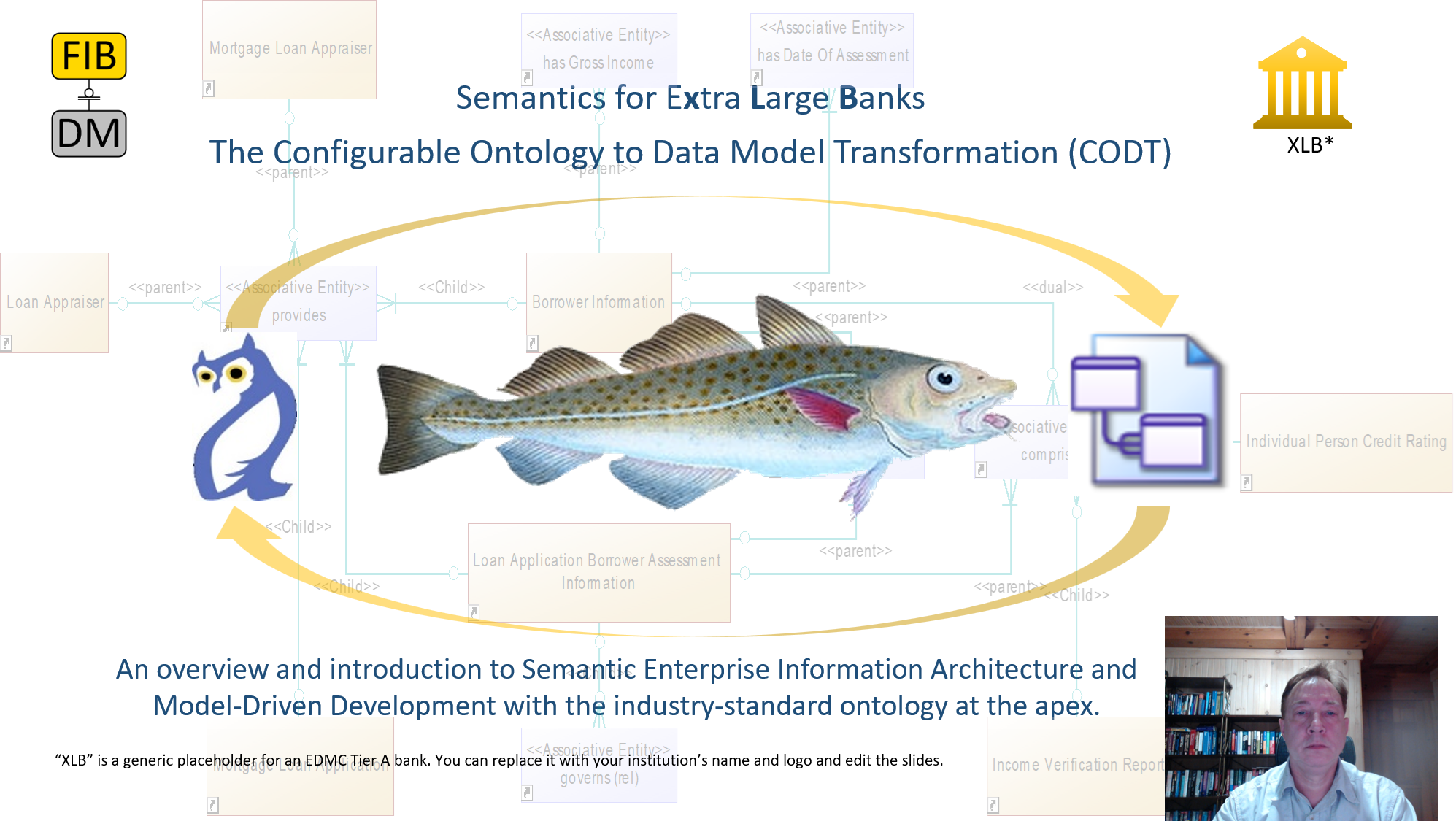

Global banks created the FIBO as an open-source industry standard for concepts, their relationships, and definitions. We used our patented Configurable Ontology to Data model Transformation (CODT) to make it available in the leading data modeling tool, SAP PowerDesigner.

The comprehensive FIBO Data Model encompasses all Financial Institutions, including funds and investment managers, and offers extensive support for Securities and Derivatives.

Banks’ scope is a subset of FIB-DM comprising Loans and Mortgages, Collateral, Accounts, Payments, and Transactions.

Banking data model resources

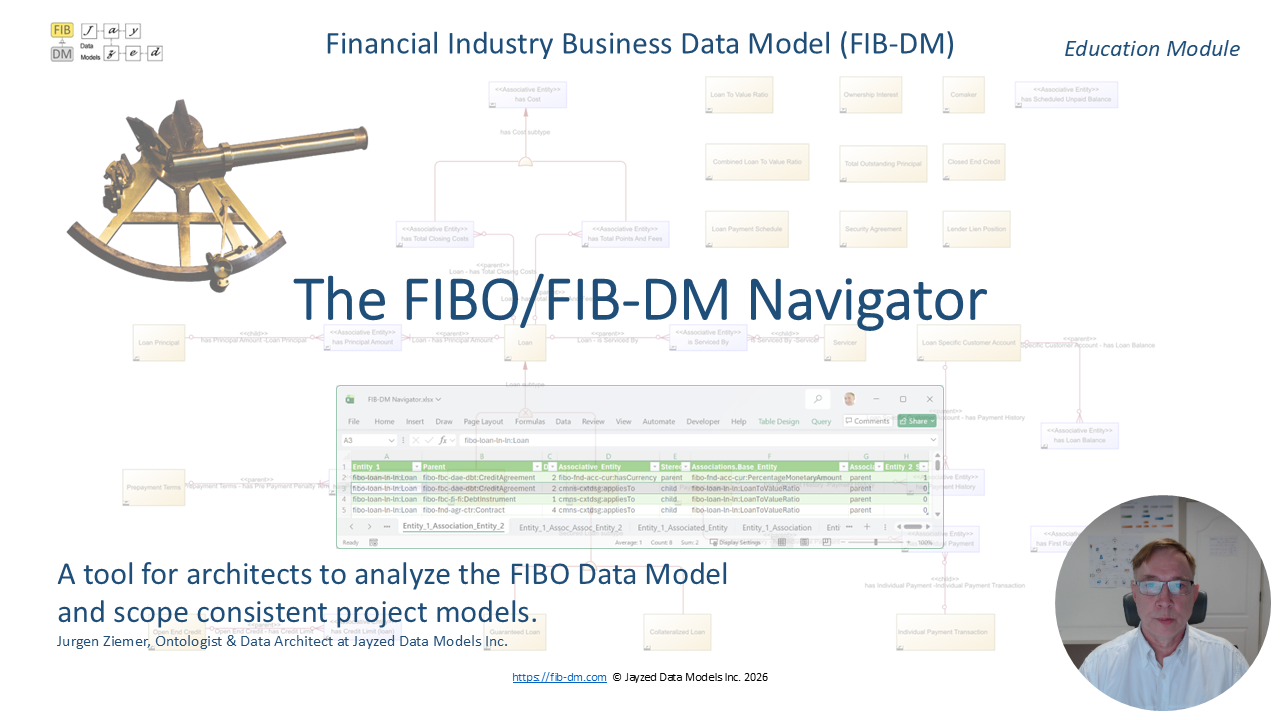

| The new FIBO/FIB-DM Navigator addresses the challenge of finding paths between entities in the massive 3,000-entity data model. This video provides an overview of the new education class. 🔗 |

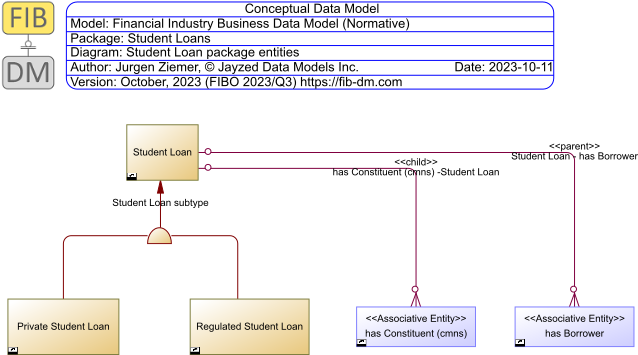

| The diagram gallery of the new Loans data model packages. |

| The U.S. Patent and Trademark Office (USPTO) has issued U.S. Patent No. 12,038,939 for the Configurable Ontology to Data Model Transformation (CODT). CODT is the technology that created the Banking Data Model. 🔗 |

| The article on this site shows how to scope a reference data model for the Call Report. |

| The companion webinar PowerPoint explains Financial Industry Fundamental Business concepts and the Call Report Entity schedule data model in detail. |

| The Semantics for Midsize Banks video examines the challenges smaller domestic banks face in using the FIBO ontology and outlines a roadmap, starting with the data model. |

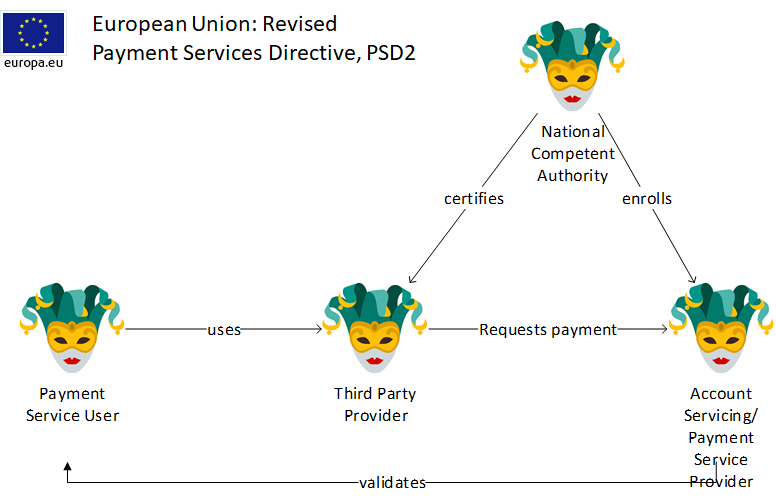

| The Semantics for Large Banks video uses the EU Revised Payment Services Directive (PSD2) as an example. |

| The Semantics for Extra Large Banks video is a tutorial on the Configurable Ontology to Data Model Transformation (CODT), which enables Financial institutions to transform their FIBO customizations and extensions. |

| The Semantics for Midsize Banks video examines the challenges smaller domestic banks face in adopting the FIBO ontology and outlines a roadmap that begins with the data model. |